If you're a GOT fan you know the line, "Winter is coming". However, I like to think "Spring is coming", well, because it is. March officially marks the month to start your seeds inside! It is the time we get to watch something tiny grow out of the earth and form life, something of which winter deprives us from seeing and for me it makes me hopeful for sunshine and warm nights on the porch. Added bonus, this is great activity if you have children, they love to keep a daily tab on the little plant in the window!

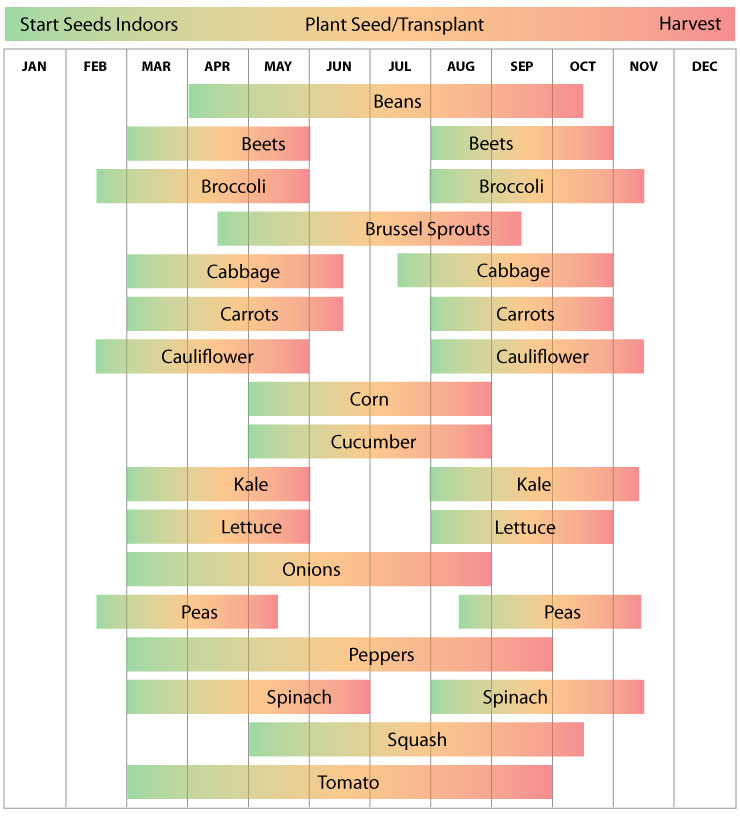

Below is a great listing of vegetables and herbs to start now, inside. The link is below if you would like more information!

March

March is the perfect time to get those tomato and pepper seeds started indoors ready for an early spring planting! Also a great time to start planting those cool weather vegetables that can withstand those last frost days of March and April. A great time to try a Garden Shot!

Beets

Sow beets now for a fast, early summer treat.

Suggested variety: Detroit Dark Red

Broccoli

If you live in a warmer climate and can find a quick growing Broccoli variety you can harvest until it bolts in the hot summer sun!

Suggested variety: Calabrese

Cabbage

Cabbage is one of the easier plants to grow in the garden. Select a variety that is right for your location (size and maturity length). Be sure to fertilize and water when cabbage head begins to form.

Suggested variety: Premium Late Flat Dutch, Golden Acre, Michihili

Carrots

Planting carrots by mid-July yields a fall crop that will keep in the garden until used.

Suggested variety: Little Finger, Scarlet Nantes

Corn

One of the most rewarding and fast growing crops to grow. Corn is delicious when cooked only minutes after being pulled off the stalk. Try a small plot of corn, working your way to a large field of several varieties.

Suggested variety: Peaches and Cream, Incredible, Sugar Buns

Cucumbers

Fast growing vine or bush cucumber plants can produce an abundance of cucumber fruits. Be careful to pick a variety for the space you have in your garden. Vine cucumbers can be the best tasting but need far more space than bush varieties.

Suggest variety: Spacemaster 80, Muncher, Marketmore 76

Herbs:

Plant heat loving herbs like basil, oregano, thyme and sage.

Suggested varieties: Italian Basil, Greek Oregano, Dill

Lettuce

Start a crop of salad mix greens that gets bright sun but not all day. Great for late summer and early fall crops.

Suggested Varieties: Buttercrunch, Mesclun Mix, Black Seeded Simpson

Melons

Melons are some of the most rewarding plants to grow. Great for hot, long summers. A staple for summer picnics and family fun.

Suggested variety: Sugar Baby, Crimson Sweet, Hales Best

Onions

Get those onion seeds growing. Be careful to select an onion variety appropriate for your garden zone. Northern areas should plant long day onions. Southern regions should plant short day onions.

Suggest variety: Sweet White Walla, Red Creol, Yellow Spanish

Peas

Green peas and sugar peas are good to plant in July, and will produce a moderate fall harvest.

Suggested variety: Sugar Ann, Oregon Giant

Peppers

Fresh, crisp peppers are a garden favorite. Peppers take up little space and can produce high yields when planted close together. Plant as many different varieties as possible. They come small, big, hot, mild, and an array of different colors.

Suggested variety: California Wonder, Early Jalapeno, Sweet Banana, Super Chili

Spinach

Spinach is more of a cool weather vegetable and will produce until hot weather of summer. Planting in early March will ensure you have plenty of harvest before bolting.

Suggested variety: Bloomsdale, Samish

Summer Squash

Yum! Summer squash sowing in June will lead to fresh squash and zucchini in July and August.

Suggested Varieties: Cocozelle, Waltham Butternut

Tomatoes

The most popular garden vegetable. Growing tomatoes is not only fun but treats you to some of the best tasting fruits in the world. Tomatoes come in many colors, shapes, taste, and sizes. Grow a few varieties every year to find your favorites!

Suggested variety: Brandywine, Cherokee Purple, Roma, Sweetie, Heirloom Blend